Insights and perspectives on Federation funds and portfolio investments.

Federation strengthens ESG and client engagement focus with key appointments

Federation Asset Management has appointed Rebecca Thomas as Investment Director and Head of Responsible Investments, while Tahlia Rozis joins as Business Development Manager.

Australia’s $170B alternative shift

Cameron Brownjohn sees a significant rise in local investor interest towards alternative investments, highlighting that over $170 billion is now allocated to these assets across Australia.

How shifting demographics is creating opportunity

Cameron Brownjohn highlights to Ausbiz that a significant transformation is underway in Australia, driven by shifting demographics and technological innovation, with a focus on opportunities emerging as 2026 approaches.

Is the ongoing conflict a threat to investment stability?

Cameron Brownjohn from Federation Asset Management states that private equity returns historically outperform other assets, a trend he sees continuing into 2025.

Federation defies global private equity slowdown in its mid-year update

Federation Asset Management has witnessed growing demand for its private equity vehicles on the back of investing actively in Asia, a new long-duration energy storage platform launch and an upgrade on its Federation Alternative Investments II Fund.

Federation Asset Management’s Cameron Brownjohn honoured in 2025 King’s Birthday Awards for business and disability advocacy.

June 10, 2025: Cameron Brownjohn, CEO and co-founder of Federation Asset Management, has been awarded the Medal of the Order of Australia (OAM) in the 2025 King’s Birthday Honours, recognising his dual service to the business sector and advocacy for Australians with disabilities. Brownjohn joins a distinguished cohort of Federation associates who have previously received […]

Federation – Update in Japan 2025

Cameron Brownjohn sits down with David Shirt from Astris Advisory Japan, to discuss the future direction of Federation for the Japanese market.

Federation Alternative Investments – Investor Notification May 2025

Federation Alternatives Investments provides access to a diversified portfolio of performing private equity investments. The Fund is performing well. The Federation team is actively working on various M&A and exit opportunities with each portfolio company in the Fund. The decision to extend the Fund life to 25 September 2026 allows more time to effect an […]

Federation – Update in Singapore 2025

Federation Asset Management’s Partner, Stephen Panizza, provides an overview of Federation’s direction for APAC 2025, while visiting Singapore.

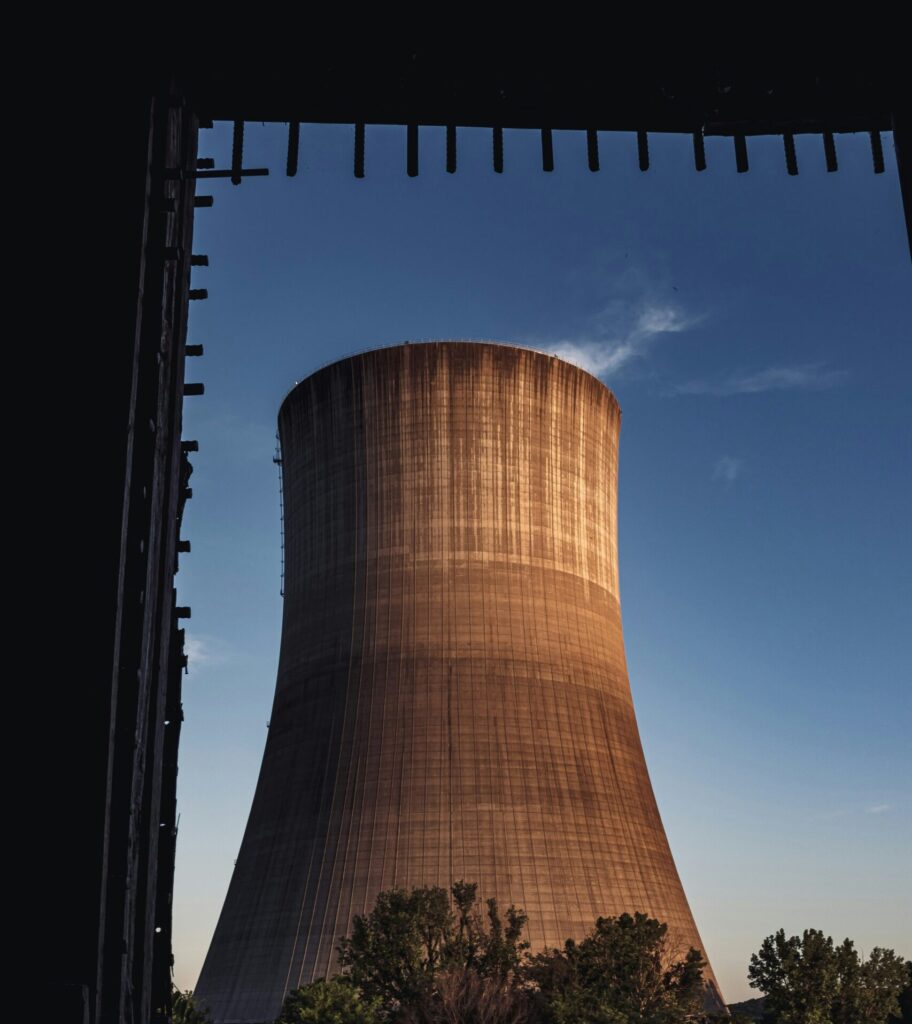

Federation Asset Management to launch energy storage platform to drive Australia’s energy future

Federation Asset Management has announced its intention to launch a new long-duration energy storage platform designed to enhance the country’s energy security and lower energy costs.

The crucial role of foreign investment in Australia

Cameron Brownjohn from Federation Asset Management states that foreign investment plays a crucial role in Australia’s economic strategy, with a nuanced approach from the government. Cameron mentions bipartisan support for initiatives to attract foreign investors, focusing on Australia’s world-class sectors like healthcare, finance, and renewable energy.

Homesafe Wealth Release

Thousands of older homeowners have found financial freedom with Homesafe – the popular option for homeowners to access the equity in the homes without going into debt or needing to downsize.

Who is Australia’s biggest renewables investor?

With an election imminent there is re-invigorated debate of energy policy, particularly on renewables.

Federation Focus – 2025 and Beyond

Federation Asset Management’s CEO, Cameron Brownjohn, provides an overview of Federation’s direction for 2025.

Retail investors to gain from private equity allocations in 2025

There is a lot of potential in certain sectors of the private equity market, which will create opportunities for retail investors heading into 2025, according to Federation Asset Management, one of Australia’s leading private markets firms. “There are three key macro trends driving the demand for private capital – sustainable energy, digitisation of the economy […]

Federation exits Merredin Energy

December 5, 2024: Federation Asset Management, one of Australia’s leading private markets firms, is pleased to announce the sale of its shares in Merredin Energy to Infragreen Group Pty Ltd. Merredin Energy is an operational 82MW liquid fired generator located in Merredin, Western Australia, connected to the South West Interconnected System (SWIS) participating in the […]

Sustainable opportunities in private equity

Cameron Brownjohn CEO of Federation speaks with Ausbiz’s Juliette Saly about promising trends for private equity in 2025, highlighting the ageing population and sustainability as key drivers. The discussion addresses the importance of strategic capital deployment in areas such as services for the elderly, renewable energy, and big batteries, especially given the current high market […]

Big battery to deliver additional renewable energy to Riverina customers

Transgrid has engaged a big battery to increase the capacity of its network in the Riverina and deliver extra renewable energy to households and businesses without building new transmission infrastructure. Australia’s largest transmission business has contracted Riverina and Darlington Point Battery Energy Storage Systems (BESS) to allow up to 120MW of additional capacity on a […]

Interest rate cut by the Federal Reserve and their implications on Private Equity

Federation’s CEO, Cameron Brownjohn, speaks with Andrew Geoghegan from Ausbiz on the role that interest rates play across the private equity sector. This conversation was quite timely in perspective of the recent rate cut from the Federal Reserve.

Benefits of Private Markets

Private market investments, like private equity, offer diversification, potential for higher returns, reduced volatility, and exclusive opportunities, making them a valuable addition to diversified portfolios.

Nuclear and Hydrogen – is it not rocket science?

As long-term investors in infrastructure that drives the decarbonisation of economies, wetake a technology agnostic approach, developing infrastructure that directly or indirectlyreduces greenhouse gas emissions (GHG) and delivers an attractive risk-return profile.

Federation continues to deliver strong private equity returns for its investors

Capping off a round of successful initiatives over the first six months of the year, Federation Asset Management, has delivered strong returns across its funds as part of its forward-looking investment strategy.

Federation – Half Year Market Update July 2024

Federation Asset Management’s CEO, Cameron Brownjohn, provides an overview of Federation’s performance to date and guides what the team is focusing on for the remainder of 2024.

Diving into Japan’s trillion dollar pension pool

As we enter the second half of 2024, Federation’s CEO, Cameron Brownjohn, provides an update on investments in Japan, childcare, disability housing, renewable energy, and equity release, emphasising growth opportunities and the company’s strategic accomplishments.

Federation Asset Management acquires Homesafe

Federation has acquired 100% of the share capital of Homesafe Solutions Pty Ltd (“Homesafe”). Homesafe is the provider of a debt-free equity release solution for older Australians to access the wealth in their homes, without going into debt or needing to downsize.

Federation Asset Management makes strategic investment in Japan

Federation Asset Management has completed its investment in Japanese financial services business, Astris Advisory Japan K.K. for an undisclosed sum.

PE exits create significant value

For private equity (PE) firms, successful exits (assetsales) realise value for investors, provide re-investmentopportunities and create a track record relevant forconsequent fund raising. Successful exits distinguish topquartile private equity firms from their peers.

Private Equity sector strengthens exposure to childcare real estate

As the Federal Government prepares to respond to the ACCC’s recommendations on childcare, along with the final report from the Productivity Commission’s investigation into childcare access, Federation Asset Management’s CEO Cameron Brownjohn believes firms like Federation play an important role in growing access to affordable childcare.

Cameron Brownjohn says the budget 2024 will have a net positive impact on their investments.

Cameron Brownjohn, CEO of Federation says the budget 2024 will have a net positive impact on their investments. Speaking with Nadine Blayney he highlighted the added investments across sectors like childcare, social housing and green energy are the biggest benefactors.

Unlocking the power of private equity

With the cost-of-living crisis impacting more and more Australian households, an increasing number of investors and their advisers are investing in private equity. But what is private equity and why are Australian investors drawn to these investments?

Private equity shows resilience in the first quarter of 2024, with green shoots emerging

Global private equity and venture capital deal value grew in the first quarter, climbing 5.1% to US $130.61 billion for the first three months of 2024 from US$124.30 billion for the same period in 2023*.

APAC private markets briefing

Federation Asset Management’s CEO, Cameron Brownjohn, provides an overview of the recent quarterly performance update for the Alternative Investments II Fund, also known as the F2 fund.

Renewable energy, batteries, childcare, NDIS & private equity | Cameron Brownjohn

Murdoch speaks with Cameron Brownjohn the CEO at Federation Asset Management about investing in mid-tier Australian private equity.

Time to look past the perceived risks in private equity: Federation | The Inside Adviser

Advisers may be holding back from private equity investment because they have an exaggerated view on the liquidity risks involved, but providers offer more liquidity now than ever, and smart advisers are capitalising on this.

Investing opportunities in childcare on ausbiz

Cameron Brownjohn and Danielle Ecuyer discuss how private equity players are exhibiting a growing inclination towards sustainable sectors, highlighting the positive outcomes when investment meets childcare centres.

Federation’s Synergis Fund co-winner of Impact Asset Manager of the Year award

The Impact Investing Hub has announced the Synergis Fund – a fund run by Social Ventures Australia and Federation Asset Management – as a joint winner of its Impact Asset Manager of the Year award for 2023.

Private Equity outlook for 2024 strong, ending 2023 on a high note

Despite a challenging year for broader public equity allocations in 2023, Federation stayed true to its investment principles and continued to deliver investors a strong return.

Federation shores up its presence in social infrastructure sector

Federation notes there is an estimated $10 billion of investment opportunity in the social infrastructure space.

Dawn of a new era in energy transition as NSW’s largest battery system goes live

Federation and Edify delivers Tesla Megapack systems to power thousands of homes andbusinesses and add grid stability.

Federation marks five years with strong returns for investors

Federation, demonstrates that private equity continues to deliver over the long-term, having built a strong five-year track record.

Federation celebrates five years of strong returns for investors

Federation Celebrating five years

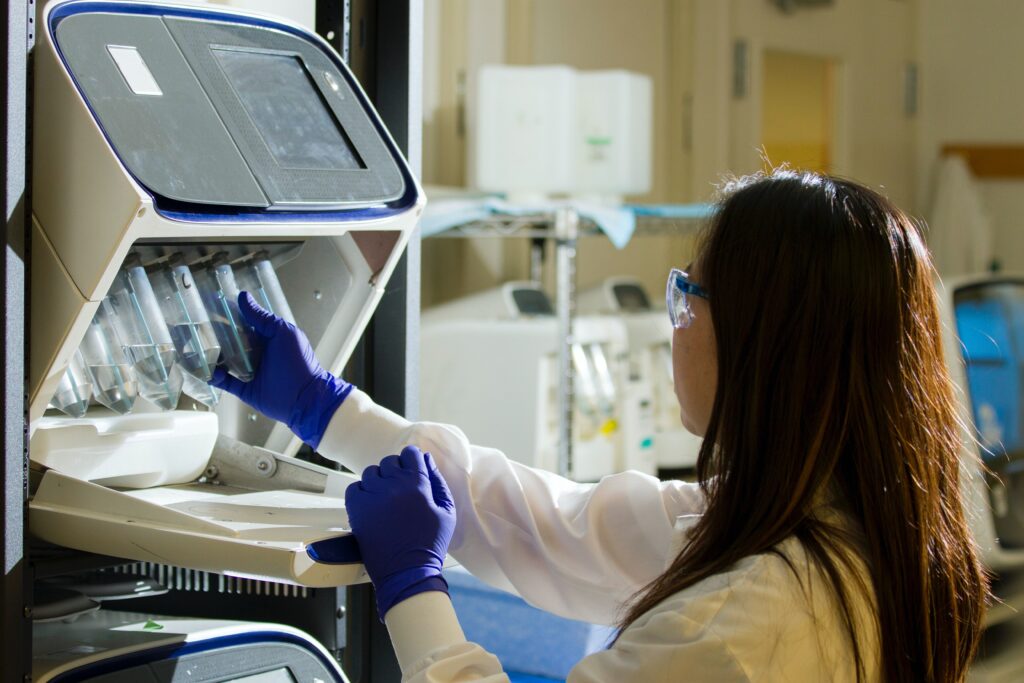

Federation Asset Management sells George Clinical, delivers a strong result for investors

Federation and its co-investors have announced the sale of their indirect investments in George Clinical to Hillhouse Capital.

Federation Alternative Investments II Fund receives endorsement from MyFiduciary research house

A tick for investment team, style and fund accessibility

Renewables opportunities ‘straight down the fairway’ for super funds

Investor Strategy News, featuring Cameron Brownjohn, discusses the low-cost capital opportunities for super funds as they are being replaced with renewable energy generation and storage.

Private equity opportunities exist despite skittish times

Be picky and patient. Despite the higher interest rates, inflation and fears of impending recession, it’s a good time to be a private equity investor in Australia, says Cameron Brownjohn from Federation.

Channel 7 Riverina Report on NSW largest battery.

Channel 7 Riverina News covers the largest NSW battery featuring Federation Asset Management's Stephen Panizza and Edify Energy's Kris Fulton discussing the National Electricity Market.

Federation leans in to support Special Olympics Australia

Federation Asset Management is pleased to support and sponsor athletes from Special Olympics Australia (SOA), ahead of Special Olympics World Games which will be held in Berlin from June 17 – 25.

Australian PE fund lands in NZ platform

In a rare private equity offer for NZ retail investors, the Australian Federation Asset Management, has added its flagship alternatives fund to the Apex (formerly MMC) platform.

Federation and Edify complete NSW’s biggest battery system

Energy Source and Distribution media article featuring Federation and Edify Energy’s new major battery system in the NSW Riverina.

NSW’s largest Battery System construction completed

Federation Asset Management Pty Ltd (Federation) and Edify Energy (Edify) haveannounced the construction completion of a major new battery system in the NSW Riverina that will be able to power 240,000 homes for two hours via the National Electricity Market (NEM).

PFI: Windlab gets Federation backing

Federation Asset Management is seeking new funding as one of its investments moves on a major project. Windlab is looking for a financial adviser on its Queensland scheme. Written by Alexandra Dockreay

Federation AM – Ausbiz

Cameron Brownjohn joined Ausbiz to discuss the advantages of investing in Private Equity.

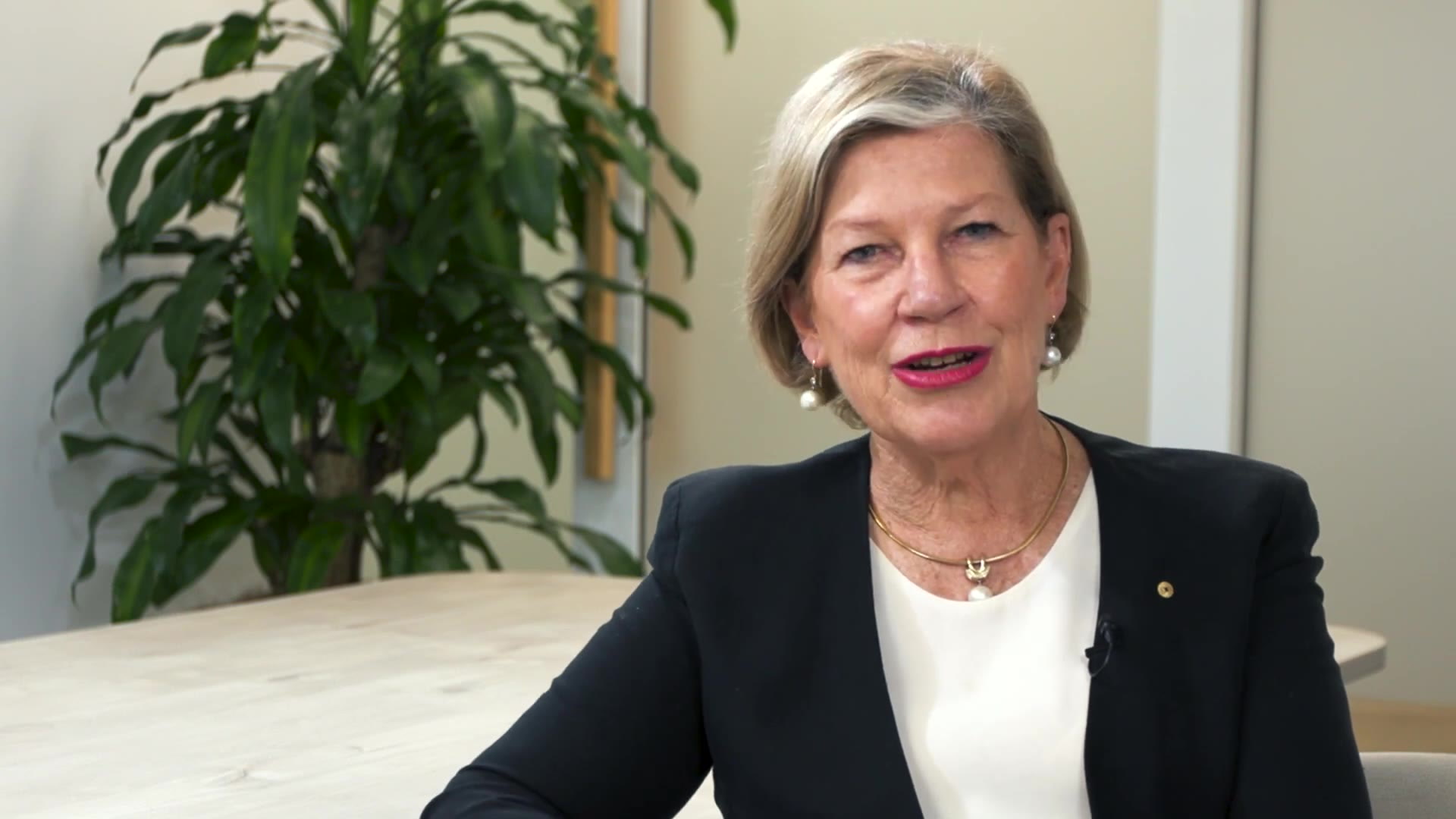

Federation AM

Ann Sherry, AO and Chair of Federation discusses our approach to both protecting and growing our clients' capital in areas that matter to society.

Federation AM – Company Overview

Federation provides a range of investments products for institutional and individual investors across real estate, infrastructure and private equity.

Federation AM – Ausbiz

Cameron Brownjohn joined Ausbiz to discuss the private equity opportunity set in the current macro environment.

Federation AM – Synergis Fund

Jason Walter, Federation Partner, sits down with Michael Lynch, Synergis Managing Director, to discuss the portfolio and the investment strategy in further detail.

Investors back sustainable infrastructure for pure-play energy transition

Demand for unlisted sustainable real assets has seen institutions join FederationAsset Management’s Sustainable Australian Real Assets Fund (SARA)

Follow the deals: To thrive in private equity, back a good fund manager

With private equity becoming more accessible, retail investors can now take advantage of the asymmetry-of-information and diversification benefits PE offers, while its safe-haven characteristics stand out in the uncertain macro environment.

Why dipping into private equity is a must for ESG investors.

Private equity investments are good ESG alternatives, according to Federation’s CameronBrownjohn

Private equity to shine as investors flock to alternatives.

Private equity has the potential to offer investors a safe harbour.

Zenith approves Federation Alternative Investments II (F2)

Leading investment research house Zenith Investment Partners has awarded Federation Asset Management’s private equity fund, Federation Alternative Investments II, an ‘approved’ rating, citing the high calibre and extensive experience of the firm’s principals.

Key Themes in the Australian Energy Transition

Stephen Panizza, Lead Partner on Renewables at Federation Asset Management, discusses the path forward on Australia's energy transition.

Merredin Energy

Merredin Energy is an electricity generation asset fully contracted to the State of Western Australia.

Sustainable Australian Real Assets

Federation’s energy transition strategy is the Sustainable Australia Real Assets trust or SARA. It provides investors the opportunity of a diversified portfolio of renewable assets, developments and technologies.

Riverina Battery Projects

Federation Asset Management and Edify energy have reached a financial close on the 150 MW/300 MWh Riverina and Darlington Point Battery Energy Storage System.

The Inside Network’s Alternatives Symposium

Cameron Brownjohn from Federation Asset Management speaks with Drew Meredith at The Inside Network’s Alternatives Symposium, 23 February 2022.

The fund making a profit and a difference

ESG (environmental, social, governance) is the latest force in investing. Federation Asset Management CEO Cameron Brownjohn tells Sean Aylmer it’s not solely about doing the right thing for the world, it’s also the key to making a profit.

Renewables: Why Australia, why now?

COP26 is over. So now what? In “Why Australia, why now” we give pragmatic consideration to the prospects for renewables investment in Australia.

Federation, BlackRock link up for childcare

Federation Asset Management has struck a joint venture with a private fund managed by BlackRock to invest in childcare real estate in Australian.

Federation Asset Management raising for second fund

Federation is pleased to announce the launch of Federation Alternative Investments II, or F2.

A look into Federation Asset Management’s Education REIT

Jason Walter overviews Sentinel, which buys and builds childcare education real estate in Australia.

Why invest in Australian Renewables now

Stephen Panizza addresses why now is an excellent opportunity to invest into Australia’s transition to green energy.

Federation portfolio company, Sendle

Federation’s Neil Brown chats with Eva Ross from Sendle.

Launch: Sustainable Australian Real Asset Trust (SARA)

Federation Asset Management is pleased to announce the launch of the Sustainable Australian Real Asset Trust (SARA).

Reducing Investment Risk in Private Equity Structuring

In the second of Federation Asset Management’s Masterclass series, you are invited to a rare behind the scenes tour with Neil Brown, Head of Private Equity at Federation AM.

Renewables Masterclass: Balancing Risk and Reward

A rare opportunity to sit at the table with the decision makers and hear what goes on behind the scenes in portfolio construction in this exciting asset class.

Australian Private Capital Market Overview

This comprehensive industry report covers activity data on funds, deals, and capital flows across the private equity, venture capital, private debt, real estate, and infrastructure & natural resources sectors in Australia.

Update on acquisitions of ASX-listed renewables developers

The acquisition of another publically listed renewable energy developer, Windlab, passed an important milestone last week after shareholders overwhelmingly voted in support of the deal.

Selecting investments and protecting capital

CEO, Cameron Brownjohn, says the team has been able to generate returns of 23% per annum since 2011 based on investments that we have exited.

Mission to tackle major global health challenges

Federation Asset Management invests in George Health Enterprises. $53 million cash injection from Australian investors - one of the country’s largest-ever private-public health partnership.

Execution of scheme implementation agreement

Windlab is pleased to announce that it has entered into a binding Scheme Implementation Agreement with Wind Acquisition 1 Pty Ltd and Squadron Wind Energy Development Pty Ltd.

Largest shareholder in Windlab

Federation Asset Management today announced that it has agreed to acquire an 18.4 per cent interest in Windlab Limited.

Federation Asset Management Launches next capital raising

Federation Asset Management today announced the launch of its next capital raising.

Sendle raises $20M in Series B funding round

Sendle raises $20M in Series B funding round to fuel growth and exploration of international markets.

Lead investor, Federation Asset Management, backs Sendle as one of its first investments.

RateSetter

Leading marketplace lender RateSetter raises $17 million in new funding to continue strong growth in consumer lending.

Open for business

Australia’s newest asset manager, Federation, today unveiled its senior investment team and launched a strategy that will provide investors with access to attractive asset classes they have historically been unable to access.