Could there have been a more unfortunate representation of Australia’s climate ambitions than our own Prime Minister wielding a lump of coal in parliament, beseeching the public to have no fear? Four years later the same Prime Minister travelled to Glasgow for COP 26 and committed us to net zero emissions by 2050.

That parliamentary pantomime never did represent the reality in the Australian energy markets. Advancements in energy efficiency, technologies, storage, and engineering, combined with highly supportive state-led policy frameworks and sound project economics are driving the transition from fossil fuels at great pace in Australia.

The opportunity for private capital to invest in renewable energy is more attractive now than ever before. New solar and wind projects are already undercutting the cheapest of existing coal-fired power plants1, and consequently Australia stands out as a world-leading renewables market, with a bright future as the cost of renewables technologies continue to decline.

Today, India and Australia are the only markets in Asia Pacific where the levelised cost of electricity for renewables is cheaper than newbuild coal, according to Wood Mackenzie, which predicts that renewables power in Australia will be 47% cheaper than new-build coal by 20302. The cost advantage will add further impetus to Australia’s energy transition.

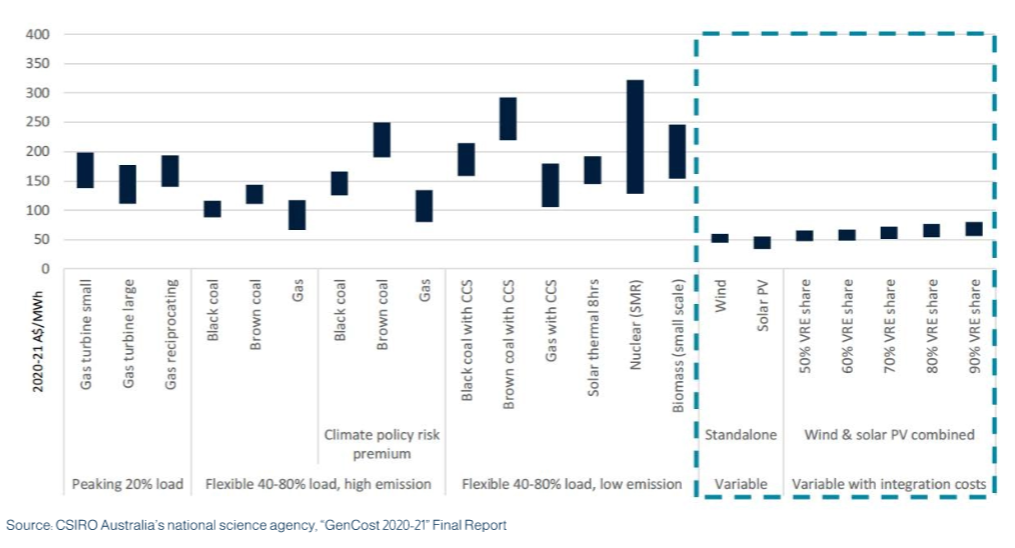

Calculated levelized cost of energy by technology and category for 2030

Source: CSIRO Australia’s national science agency, “GenCost 2020-21” Final Report

Despite Australia’s abundant coal reserves, the repeal of an early carbon price mechanism3 and the lack of a feed-in-tariff program4 to accelerate renewable energy investments, there has not been a single coal fired power station commissioned in the National Electricity Market (NEM) in 14 years. Personally, I doubt there will be another absent direct government intervention. In March 2021, Australia’s third largest power retailer announced that it would shut its ageing 1,450 megawatt (MW) Yallourn power station four years early5. Other early coal closures such as Liddell (2,000 MW) in 2023 are demonstrable proof that thermal generation can no longer compete with renewables.

Australian Energy Security Board Chair Dr Kerry Schott has predicted coal-fired power will disappear completely from the NEM by the mid-2030s if not earlier – cutting short the rated life of some generators by more than a decade; “Coal is inexorably leaving the system and I personally think it’s going to leave much faster than people initially thought. It really is struggling to make money,” 6

Staying Ahead of Coal Retirements

The stated core objective of the Federal Government’s energy policy is to lower energy prices in Australia. The only feasible way of achieving this is to increase renewable penetration. Yet, the NEM remains reliant upon coal-fired power stations. The coal fleet is old, unreliable, and expensive. Therein lies the problem and the opportunity: 15 gigawatts (GW) of coal fleet is approaching the end of its life and must be replaced by 2040. This will happen much sooner, as the coal fleet is losing money due to low-cost renewable energy entering the market.

The Australian Energy Market Operator (AEMO) estimates that 60 GW of renewable energy capacity7 will need to be built in the next 19 years to replace the coal fleet. That will require more than A$150 bn in capital expenditure on generation alone. Major upgrades to grid and distribution infrastructure, and introduction of energy storage systems will increase this requirement substantially. We have learned that we need to be in front of retirements. Australia’s first major coal plant closure, that of the Hazelwood power station in 2017, has already alerted us to the disruptive consequences of sudden and unplanned coal exits; namely, spikes in electricity prices and higher risks of blackouts during periods of extreme demand.

While the task is large, the course is clear. A great deal has been learned from the teething problems in integrating solar, wind and other Variable Renewable Energy (VRE) into legacy grid assets. AEMO’s Integrated System Plan (ISP) is a recognition of the need to carefully orchestrate grid augmentation alongside renewable generation installation.

Integrating a Growing Clean Energy Mix

While the Federal government has committed Australia to net zero by 2050 it has announced no specific policy initiatives, nor proposed legislation to achieve the goal. The Federal Government can get away with this because it is the State Governments that are doing the heavy lifting in clean energy policy.

Climate leadership at the State Government level is substantial; each State has already committed to net zero, and enacted policies in support of energy transition. For example, the establishment of Renewable Energy Zones with clear planning of grid augmentation to support generation is well-developed, in New South Wales and Queensland in particular. However, to take VRE penetration from the current 25%8 to 50% and beyond, more storage capacity is required, at scale.

This presents a major opportunity for Battery Energy Storage Systems (BESS). Australia is a leader in large-scale BESS – the Hornsdale Power Reserve project in South Australia is the largest lithium-ion battery in the world. State governments and major energy retailers alike are showing leadership in BESS. Each of the three largest thermal generators have committed to large scale BESS investment ahead of coal decommissioning. The 300 MW / 450 MWH Victorian Big Battery9 is scheduled to be commissioned in Q4, 2021. AEMO estimates that they’re 85 BESS with a total capacity of 18,660 MW in the planning pipeline in the NEM10. This does not include battery installations in the home, where one in four Australian houses have rooftop solar installed.

Windlab, an Australian wind farm developer, conducted a study on the amount of storage that would be required to support very high renewable penetration in the NEM. The study drew upon actual data from the 14-day periods in 2017 and in 2018 with the lowest VRE generation. Windlab concluded that the NEM could support 94% renewable penetration, with additional storage comprising Snowy 2.0 (2 GW / 350 GWh) plus an additional 8.6GW / 13.8 GWh in BESS or other storage technologies.

The opportunity for wind generation in Australia is particularly attractive. Solar generation in the NEM is highly correlated; while the grid is 5,000 km long it’s not wide East to West, meaning practically all of the solar generation comes onto the system at the same time11. Furthermore, household rooftop solar installation is expected to continue at pace from the 5 GW installed today to 20 GW forecast by 203612. This will exacerbate our so-called “duck curve”, which reflects the timing imbalance between energy production and peak demand. Under these circumstances, wind has several advantages over solar. Wind resources across the NEM exhibit a lower generation correlation than solar, and a low – sometimes negative – diurnal correlation with solar. Wind farms also have higher net capacity factors (now approaching 50% onshore versus maximum 28% for solar). Wind farm operators therefore command higher generation-weighted prices than solar power operators in the NEM.

The increasing penetration of rooftop solar and the consequential reduction in off peak pricing creates a substantial opportunity for storage in the NEM. The combination of low-cost wind generation with storage benefitting from low, and increasingly negative13, off peak prices is creating a compelling opportunity to deliver firm renewable energy.

Australia has long been recognised as a leader in private infrastructure investment, both within our borders, and around the globe. We shall build on this legacy in the A$150 bn energy transition that is under way.

Back

Back